Let’s Talk More About Compliance Officers’ Pay

After a couple of articles on why compliance people are sometimes underpaid and how they can make more money, I got so much feedback and input so I decided to expand the topic and make it a bit more comprehensive.

How much do people pay Compliance Officers? 💰

- Junior compliance employees in Europe usually start at 30-40k EUR a year with no or a couple of years of experience.

- Compliance managers or heads of departments could make about 65-80k EUR a year. In Switzerland, California, or New York you could add maybe 25% to this and in Singapore or HK, it would be a bit less.

- CCOs of startups are paid from 110-130k EUR a year (when it’s their first role at that level) and if they are also the Head of Legal or Head of Risk and their startup is well funded they could earn between 150k -180k EUR. One could argue if this is too much or too low, you decide. 🤓

- Obviously, when we are talking about larger institutions where the CCO is also a board member or leads a team of 500+ people the scale can shift.

In summary, initially, I suggested that the main strategies for compliance experts to make more money would be to:

- get a new job

- become an independent Board Member (or Non-Executive Director aka “NED”)

- become a paid advisor or a co-founder for a new startup.

In addition, my audience suggested a few more strategies:

- paid teaching (at universities, as a part of NGO, inside formal acceleration programs)

- paid speaking at conferenced

- writing books or paid articles

- joining working groups and various governmental and pan-governmental research or industry initiatives, that eventually may convert into paid assignments

Below I summarize my views about the pros and cons of each of the strategies:

✅ Get a new job

This is by far the most common strategy, but it is a one-time impact, which makes it limited.

- You get a one-time increase of 10-20% and then your compensation is growing very slowly (or not at all, because most startups don’t have a formal salary increase or salary review policies)

- Compliance people often prefer certainty and stability and tend to be risk-averse, so changing companies and creating a resume of a job hopper is not something that they would do just for fun. There is always a hope that the next job will last (but then see the first bullet point about stagnating salaries).

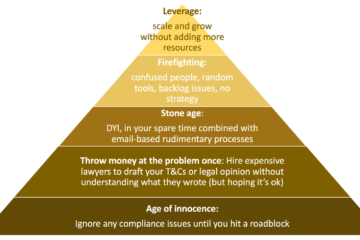

- Changing jobs is not a sustainable solution unless you can completely redefine the role of compliance in the organization and increase the actual and perceived value of what you do. This is why changing jobs rarely brings lasting results.

✅ Become a Board Member for another FinTech company.

Objections many people have about it:

- It’s hard to find credible startups.

- It is only possible for people with connections and through introductions.

- It’s too much of a liability.

- What happens to my reputation if they go out of business?

Despite all hesitations above, becoming a Board Member is a “dream-come-true” option for many because a board seat is seen as a respectable position with lots of credibility and influence, usually “safe” from the conflicts of interests, so it’s relatively easy to get your employer’s approval for that.

The problem is that FinTech startups usually don’t want to add random compliance officers to their Boards. They want their Board Members to bring in investments, influence, connections, partnerships, and growth opportunities, and compliance officers are not perceived as capable of doing that. I am often asked by my clients to recommend board members, and the list of “job specs” rarely includes understanding regulations or risks. The days when Board Members enjoyed a nice income and had little responsibilities are slowly but surely going away, because FinTechs are under more and more pressure to grow and become profitable. If your skillset is not viewed as “growth-focused” and if you don’t have a track record of enabling business expansion and bringing in revenues or partnerships, most founders won’t be impressed.

✅ Become a paid advisor with an equity stake or a co-founder for a new startup and help them grow

- This option is a bit riskier and less certain than a Board seat (from the revenue-generating perspective) because most compliance officers are not M&A experts and don’t know how to evaluate the commercial opportunity of a startup and their chances of becoming successful.

- Another huge objection I hear often about this option is TIME. Yes, growing a new company is demanding and time-consuming, but compliance officers rarely feel they have the time. You may dream that maybe one day you will have more time to start something more entrepreneurial, but probably not today.

In all cases above, we see a common underlying issue – to earn more money and get exposure to more opportunities, it is imperative that compliance officers are able to demonstrate that they are able to generate commercial benefits and tangible results for their current company, be able to clearly communicate and quantify what these results are, and use resources and time available to them wisely.

✅ Become a paid teaching, paid speaking, or paid writing pro

I feel like all those options can be grouped into one, which is essentially adding marketing activities to your skillset and monetizing your know-how – through speeches, books, or teaching. The positive impact of those activities is that they can potentially increase your professional reputation and credibility in the industry, and you may be introduced to new opportunities through this. The downside of those strategies is that they rarely bring lots of money, they are very time-consuming and most compliance experts don’t actually like self-promotion and feel uncomfortable being in the center of attention. Knowledge or deep expertise don’t sell themselves automatically, you need to master marketing and sales skills and enjoy the process for this strategy to work and bring you desired financial benefits.

Would be great to hear from you about compliance topics or challenges that occupy your mind. 💭