How To Make Decisions If Your CEO and Compliance Disagree?

If you work in FinTech compliance, you already heard me say that hard work, extensive research, attention to detail, and deep regulatory knowledge is not the best way to solve compliance issues and add value within FinTech.

You may be shaking your head in disbelief and I totally get it. I understand. For years and decades, compliance professional has been taught that knowledge and information is power and that the way to add value to your company is to provide accurate and extensive information for your management to enable their decisions.

However, think about it. Most CCOs, MLROs, and Heads of Compliance you know are likely very diligent, hard-working, and knowledgeable people. However, most of them never get promoted within their companies, change jobs every 2-3 years to get ahead, and often complain that their senior management does not listen to them and does not include them in important decisions.

The opposite example is also very common: instead of implementing the recommendations of the compliance team, the CEO would make the decision to copy the strategy of your competitors or follow the advice of external consultants who may not be very knowledgeable and definitely have no skin in the game in terms of helping the company address unwanted consequences of these external influencers.

What makes the external advice or external examples so appealing? Why well-researched internal recommendations are often dismissed? Why it is so hard to be a prophet in your own land?

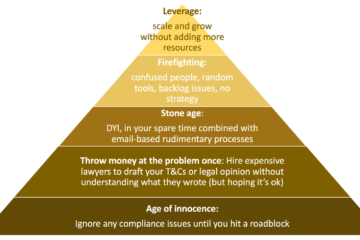

Well, the answer is actually very simple. Competitor examples and external advice (regardless of whether it’s going to work for your company or not) offer ideas on how to solve a business problem, not a compliance problem. They are based on the ROI method, or financial cost-benefit analysis.

The CEO of the business already has a goal in mind, and they are looking for answers on how to get there. This is the answer.

If you are a compliance leader and you would like to make your recommendations implemented and your opinion well respected within your company, you need to structure all your proposals using the ROI method and answer the question of how to achieve your company’s business objectives.

Consider the situation from the CEO’s perspective.

A lot of FinTech CEOs are frustrated about the cost of compliance and speed of compliance, and they ask themselves and others “How do I make my compliance function more efficient and supportive of business needs?” or Where do I find a different compliance leader who will be more efficient and supportive of business needs?“

FinTech CEOs sometimes have a strange passive-aggressive relationship with compliance. They don’t really know when they should act or overrule compliance recommendations and when it’s better to listen and agree. Sometimes they get so uncomfortable, they just ghost their compliance leader and exclude them from most meetings.

As it is with any area, if you don’t have a clear objective consistent approach to how you make executive decisions (in this case about compliance), if you don’t have a proven process of weighing pros and cons and making conclusions, in heated moments you are likely to act based on emotions and get impatient or biased.

So, as a CEO, if you’d like to be a consistent leader, you need a process involving sound deductive reasoning and a set of guiding principles that you can apply before acting (or overreacting) around compliance. ROI method of evaluating compliance proposals is a perfect tool to do that.

During my 7 years of supporting FinTech startups and teaching FinTech compliance leaders, I discovered 3 main guiding principles for helping FinTech startups build the bridge between the business side and the compliance team.

- The business decides what and when, and compliance decides how. Important: compliance does not decide if it’s possible or not, compliance decides how.

- Dismiss all “but what if this happens” with a low probability of this event ever happening (anything below 30%) and don’t overinvest in these possible eventualities ahead of time.

- Evaluate all compliance proposals the same way you assess marketing or business development projects, using the ROI method.

Enjoy listening to podcasts instead of reading? – Tune in to this episode here!

If you would like to learn more, about how to implement the ROI method within your FinTech compliance function, and why it works wonderfully, especially for startups, you absolutely must join this 90-minute totally FREE and value-packed training about 3 indispensable ingredients defining the success of your FinTech Compliance function (instantly available on demand). Enjoy the training if you missed it, and let me know your thoughts!