FinTech Compliance Self-Starter Package

This package provides you with the complete set of resources and templates PLUS step-by-step guidance on how to set up and manage all essential aspects of your FinTech Compliance program – efficiently and on a budget!

Whether you are a compliance expert or a founder handling your company's compliance, the worst possible in compliance is starting from scratch! Stop reinventing policies, processes, or documentation for partners – we've got you covered!

LET ME SHOW YOU WHAT IS WAITING FOR YOU INSIDE THE SELF-STARTER PACKAGE ONCE YOU JOIN:

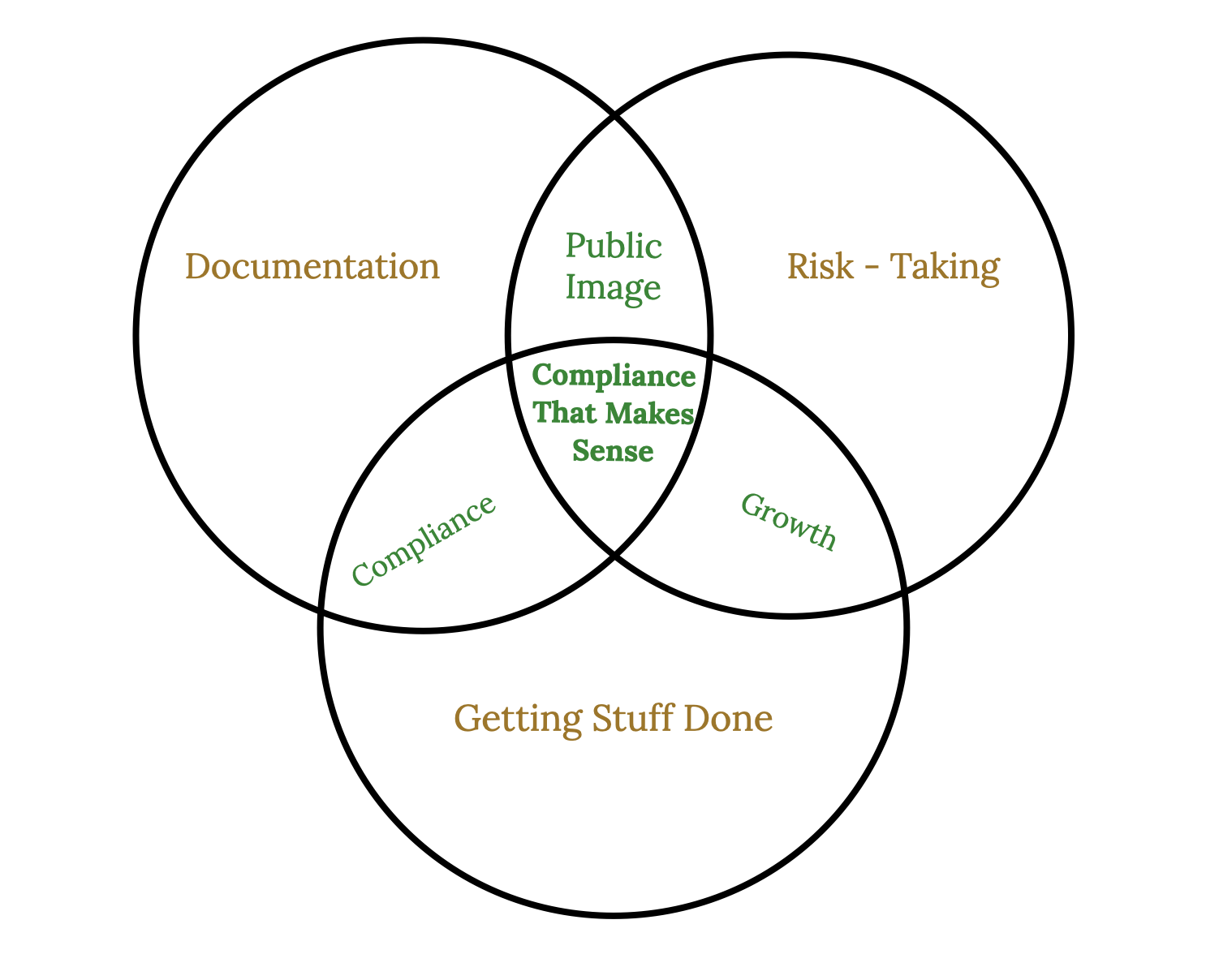

Successful scalable Just-in-Time compliance is ALWAYS based on 3 foundational pillars:

- Pragmatic Risk-Acceptance

- Operational Processes or Getting Stuff Done.

- Documentation

Why are these 3 components so essential?

- Pragmatic risk acceptance combined with efficient processes will create growth and scale.

- But… without documentation and policies, you will experience an “undocumented growth” which is a problem, when it comes to securing important partnerships and licenses or regulatory recognition (think Binance).

- Efficient processes combined with documentation will equal compliance because you do what your policies say, but without risk-taking, you end up being a conservative, rigid old-fashioned bank.

- Risk-taking combined with great documentation will create a great public image, but if you don’t actually do what your policies say, it is window-dressing, and you’ll get caught (think Wirecard or FTX).

1. Pragmatic risk acceptance.

- The FinTech Compliance Performance training is designed to help you build, expand and optimize your compliance, set relevant goals, assess performance and resolve most common organizational conflicts related to compliance responsibilities and division of labor. The worst possible mistake one can make when asking for compliance resources is to claim that this expenditure "is mandatory". When your CEO or CFO hear that something is mandatory, they believe it's similar to paying taxes, which creates a strong tendency to minimize and delay the expense instead of considering possible benefits.

- The Rise of the Business-Like CCO training will debunk the outdated corporate employee “Boomer” stereotypes and the old-fashioned myth about risks and compliance. This “Boomer” mentality emerges when someone believes that their value and accomplishments come from efforts and accumulating more information — working longer, trying harder, accumulating more knowledge, and preparing for countless remote risks “just-in-case” (which is a broken strategy). Successful business-like CCOs and compliance leaders think very differently about risks, uncertainties and growth. They are unafraid of mistakes, and they don't merely search for solutions – they create solutions. They manage their compliance function as a profit center, not a cost center. They rely on cost-benefit analysis instead of the outdated Gap Analysis approach to assess new business opportunities or manage regulatory changes.

- The practical implementation of the new approach to risk is covered within the Business Wide Risk Assessment workshop.

- Risk Management Policy and Risk Assessment Templates cover all key aspects of your FinTech or Crypto business .

2. Just-in-Time Processes.

Another massive opportunity for compliance to add value is to drive efficiencies, save costs, reduce unnecessary checks and controls around customer onboarding and transaction monitoring, as well as simplify and standardize how you are responding to regulators, drafting reports, and managing ongoing inspections and audits. These processes need to be streamlined and simplified, otherwise, your compliance team will be spending too much time on documentation and not enough time on reviewing new projects, new clients, and new opportunities.

Implementation workshops for all critical aspects of compliance operations are included:

- Opening bank accounts

- Managing your own FinTech licensing

- Structuring White-Label solutions

- Choosing between the white-label and your own licensing

- FATCA/CRS implementation workshop

- Onboarding and risk-rating for corporate customers

- Performing due diligence on your future financial partners (to avoid the risk of over-reliance on Wirecard, FTX or Railsbank)

- Creating your FinTech Privacy Policy and managing your GDPR compliance

- End-to-end Blockchain Compliance

- Preparing for and managing external audits

- Standardizing and simplifying you annual compliance reporting

- Complying with Apple and Google Appstore Guidelines

- Documenting your Outsourcing

3. Documentation and policies

Regulatory and other approvals are often secured by preparing disclosures, reports, and policies. Our tried-and-tested templates are continuously fine-tuned and updated, based on feedback received from our clients. The worst possible mistake you can make with compliance policies is to start from scratch. Our templates will save you time and resources previously spent on reinventing the wheel and starting from scratch with a blank page syndrome!

This package of FinTech Compliance templates is updated for 2024 and includes all mandatory elements to set up your FinTech compliance documentation:

- AML, KYC, PEPs, sanctions policies and SOPs, onboarding flow setup guide (including policies, tools review, and guidance on admin and case management setup)

- Privacy and GDPR module, including privacy policy, GDPR compliance policy, binding corporate rules, and standard contractual closes or Data Transfer Appendix template (to be included in all your contracts with vendors and payments partners where data transfer is involved)

- Outsourcing framework setup, including outsourcing policy template and outsourcing assessment checklist

- Consumer and Investor Protection, including Customer Protection and Complaints Handling Policy, Investor Protection Policy, and Customer Funds Safeguarding Procedure (for fiat and crypto services)

- Information Security, including InfoSec policy, incident management, and business continuity policy

- Blockchain-specific regulations, including Blockchain Operational compliance policy

- Corporate Governance and Board of Directors set up, Code of Conduct, Segregation of Duties guidance, Anti-Bribery and Corruption procedure, and other relevant templates (e.g. gift policy, HR screening, etc.)

- Business-wide risk assessment and product risk assessment (with dedicated sections for AML, Product, VASPs, General Risks, Financial Risks, Startup Risks, and Regulatory Risks)

- Risk Management, Assessment, and Fraud Prevention, including relevant Risk Management policy and Risk Assessment and Risk Assessment methodology templates

- Conflict of Interests and Insider Trading Policy

- Terms of Service, Affiliation and Loyalty Programs structuring (including sample language for loyalty points or reward programs, beta testing provisions, and affiliation program templates)

- Inter-Company Agreements and SLAs

- Detailed and comprehensive Annual Compliance Plan and sample Internal Audit Plan. Compliance Assurance Framework (roles of FLOD, SLOD, audit)

- FinTech Licensing - including License Application Template, financial projections template, business plan template, FinTech licensing roadmap, first regulatory inquiry template

- Token listing and token assessment criteria (for cryptocurrency exchanges or wallets).

- FATCA and CRS compliance policy

The 3 main pillars of the Self-Starter will completely transform the way you approach FinTech compliance. But it's only the beginning.

When you invest into the Self-Starter Package, you also get 3 MASSIVE BONUS bundles to make your progress even faster and your transition to Just-in-Time Compliance even easier. Starting with…

BONUS 1: FINTECH STARTUP COMPLIANCE PRO CERTIFICATION

This program allows you to complete our very unique FinTech Compliance certification that will elevate your competence and confidence to the next level where you feel ready not only to set and manage a superb compliance program within your FinTech startup, but will have a framework for making pragmatic risk-based decisions.

The Certification Schedule for 2024

3 cohorts are currently planned for 2024:

- Starting on January 15 and graduating by April 15.

- Starting on April 15 and graduating by August 15.

- Starting on September 16 and graduating by December 16.

If you would like to obtain the official certification as a "Certified Startup FinTech Compliance Pro", you will be asked to complete a number of mandatory trainings and prepare your case study project, which will be assessed and graded.

Below is the Certification-specific curriculum:

1. Goal-setting. Our first group call is a workshop dedicated to determining specific deliverables or professional results each participant decides to set for themselves or their function.

2. Manage regulatory change workshop is dedicated to developing the skills needed to prepare and manage any regulatory change. We will use the example of MICA Regulation.

3. Preparing compliance ROI. We will have a special training where the participants will have to analyze key components of the compliance costs and the composition of the compliance budget. They will have to prepare a project analysis for a new compliance initiative using ROI method.

4. Developing Annual Compliance Plan training covers the following areas:

- Organizational structure

- Hiring and firing principles

- Setting revenue-generating objectives

- Making ROI-based resource estimates

- Defining KPIs for all key compliance areas: new products, AML, risk management, reporting, outsourcing, funds safeguarding, and governance.

5. Behaviors that keep us stuck. Everyone who was unable to take an agreed-upon action, feels “behind” or otherwise is unhappy with their progress, will have to assess what is preventing them from taking a different action and will get coaching and feedback on how to make the changes they desire to see.

Final Assignment – where can you take more risks? The participants will have to identify, prepare, and justify a case study about where their function or company should take more risks.

BONUS 2: FinTech Compliance for beginners module (or a refresher if you are new in FinTech but not new in compliance).

BONUS 3: Q&A calls archive with dozens of compliance and risk case studies and real-live examples and questions answered!

Which of these results and outcomes would you like the most?

"Yana is an outstanding and seasoned compliance & regulatory professional who has extensive experience and knowledge in crypto and fintech in general. She is one of the most valuable partner for our strategic advisory from compliance point of view. As her company name suggests, if you want your compliance team to be “competitive”, she is the best person to speak to."

Rikiya Masuda – Head of bitFlyer Europe, Director of the Board

I come from a legal background, and my mindset was all about being conservative, risk-averse, and disconnected from the business. But then Yana's podcast changed everything. I was shocked when I first heard that compliance should genuinely care about the business, understand marketing, care about conversions. It hit me like a lightning bolt - "Wait, aren't we the second line of defense, independent from the business and guarding company from the risk?" It took me a little time to realize that I had been wrong all along, even with my four CAMS certificates feeling useless and like a waste of money (despite some companies still requiring them!). Before long, I discovered Yana's concept of 'business-like and just in time compliance,' and it was like magic. Suddenly, compliance was being heard, invited to important meetings, and kept in the loop about product changes way ahead of time. We became trusted partners to the business, no longer just the department of 'NO.' It's crazy to think about how far we've come. From a company in its 'age of innocence,' with undocumented growth, to a compliance function that's now a 'leverage' for the company. We're securing crucial partnerships, opening bank accounts, obtaining licenses and authorizations, and acing audits. Yana's guidance has been invaluable. I wholeheartedly recommend her products, especially the Compliance Collective. They have been one of the absolute best investments in my professional career. Yana rocks!

Anastasiia Vasylieva – Full-Stack Compliance CAMS • Robocash

"Yana has incredible depth of knowledge on the compliance and regulatory needs in the Fintech and Crypto space across the UK and Europe. She has provided the highest level of insight and been very proactive to help us achieve our company goals."

Elizabeth Rossiello – CEO & Founder, AZA

"Yana is an incredibly knowledgeable, experienced regulatory & compliance consultant with whom I had the pleasure of working for several years when I was the COO of AZA, an emerging markets fintech company. I especially appreciated her versatility as a consultant - not only did she roll up her sleeves and lead tactical projects such as the re-authorisation of our UK and EU payment licenses (which involved a lot of policy writing), but also added long-term strategic value by coaching our Legal & Compliance Team to prepare for presentations to regulators at various Central Banks across Africa."

Charlene Chen – COO at Lantum | Co-Founder of COOhort and Operations Nation

"Yana is an outstanding Compliance and Regulatory Risk professional. I've learnt so much from her working with her in the executive team. Her risk-managed yet business friendly approach balances customer needs, technical requirements and regulatory obligations in a manner that turns compliance into a business advantage. Her knowledge of regulatory environments, licensing, risk and AML controls allowed our team to push products that nobody else could match while keeping bad actors and fraudulent transactions well below industry benchmarks. I highly recommend having her guidance and expertise on your team at any stage of your business."

Alvin Jiang – VP, Product & Engineering at TenX

"It’s rare that you come across standout talent like Yana. I had the pleasure of working with her for nearly three years at Mara, BitPesa (now AZA) and Founders Bank collectively, we often collaborate closely on FinTech projects with heavy compliance requirements. I am always impressed by Yana's ability to bridge the gap between scalable technical solutions and solid compliance leadership and guidance—effortlessly. That skill often takes years to develop, but it seemed to come perfectly naturally. I always enjoy working with Yana, as a team member or a leader, Yana earns my highest recommendation."

Dearg OBartuin – Founder & CEO OpenBank Innovation

"Yana has been an invaluable support in providing feedback and practical solutions to queries I have had relating to new or old regulations. Yana not only provides clarity but also rich templates that can be easily adapted and incorporated into new or existing governance processes. Yana's experience ensure these solutions are operational to add value to any business or fintech solution."

Pat Patterson – Head of Risk & Compliance at Soldo

"I find materials and courses by Yana Afanasieva very inspiring, insights she shares help me find effective solutions in my everyday routine. Moreover, I have changed my attitude, and draft documents, reports, answer requests from another perspective, as a result - me and my colleagues think positive, meet challenges of business requests with due responsibility, but overall set of measures aims to ensure simplification of processes."

Anna Lind – Foreign Legal Consultant at D2

“All information is professionally aggregated, filtered and presented - Competitive Compliance is a real timesaver for FinTech companies! Being a Compliance Associate in a regulated entity, I can already say that a lot of materials are very useful for building and enhancing our policies and procedures.Thank you, Yana, for sharing your experience and expertise!”

Iaroslav Kovshikov – Compliance Associate at SnapSwap

Fintech Startup Compliance Pro Certification experience. In a world of endless regulatory reports, audits, partner due diligences, incidents, documentation updates, and licensing, I am somehow not losing focus and am always able to do the right thing at the right time by applying Yana’s just-in-time method. It's important to note that this certification isn't a quick fix for personal change. It's more of a journey, taking several months of effort to adopt the right mindset. Another great thing is that it doesn't treat compliance in isolation. Compliance professionals dream, burn out, get sick, have feelings, and want to work on great stuff. Yana's coaching combines compliance expertise and addresses both the technical and human aspects of the profession. It's been a significant help for me, and I think it could be for others too.

Anastasiia Vasylieva – Full-Stack Compliance CAMS • Robocash