I Just Interviewed A Few People Who Lost Their Jobs in Crypto – What Happens When Your Startup Fails…

Many people who recently lost jobs at BlockFi, Crypto.com, Celcius, Stripe, and PayPal find it hard to secure new jobs because of THIS.

Several of my clients are hiring for various roles and they asked me to interview their finalist candidates. It just so happened that all of the candidates I talked to recently lost their jobs with famous crypto and FinTech startups that either went under or had serious problems and layoffs.

My main question was whether these senior executives saw problems coming, how were they trying to address these problems and whether or not with the current knowledge, they would have done something differently.

The main mistake many people make that prevents them from getting hired again is when they say:

- “We were such a great talented team, I was hoping that things will turn around, I could not imagine that the situation was so bad.”

- “I saw the problems, I raised the problems to the senior management but they did not listen.”

- “The problems were with sales, and my job was finance (or the problems were with finance and my job was sales), so I was just focused on my job.”

You can almost see the overall vibe of the person on the other side of the Zoom call: they feel that they were doing a very good job, they worked very hard, and everything that happened to their company and their industry was completely outside their control, and it is incredibly unfair that they lost their job at no fault of their own. And I totally get it and see why they feel that way.

However, there is a serious gap here.

What these answers have in common and why they are so counter-productive is that they completely lack perspective. I was not interviewing interns, I was interviewing heads of functions, and C-level and BOD-level candidates. At that level, you would expect that the person will not simply interpret the situation as them being a victim of unfortunate circumstances. Quite opposite – you’d expect them to take some responsibility for what was happening and how they could have influenced the situation.

During the interviews, I kept asking questions, “Did you see the reports about Terra/Luna? Did you see the beginning of the recession? How did you interpret the news about FTX…?“. The most common answer I heard was “Yes, I saw that, but I was too busy with my current job to really pay attention.

Again – BLIND SPOTS, lack of bigger VISION, and lack of OUTSIDE PERSPECTIVE.

The turbulence in the market is nowhere near over and the level of uncertainties is ever-increasing, which is why it is so important to have this outside view, fresh insights, and access to outside-the-box ideas. It is about feeling good, sharing stories, or learning something interesting – being able to see what you don’t see is actually a serious survival strategy.

This is exactly why I am inviting you to join the FINTECH COMPLIANCE COLLECTIVE!

The first students already joined and even shared with me their immediate issues – how to negotiate and accept the BOD role, concerned that the company is unfocused and will be running out of money, handling difficult relationships between co-founders, having to let half of their team go and dealing with low moral… These answers cannot be found in the legal books or googled, unfortunately.

Everyone who wants to be successful and make better decisions for themselves and their companies needs mentors, advisors, peer feedback, and a safe intelligent space to reflect on where they are and what can they do.

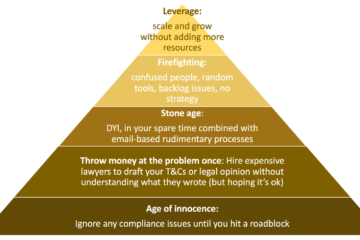

My ultimate goal is to elevate the prestige and reputation of compliance as a function by helping as many regulatory experts as I can become not just more efficient or competent, but also more influential and impactful. It’s for that reason that I designed this program to be compact, action-focused, and as affordable as possible.

I will give you the practical tools and resources to reduce your workload, become more efficient, and free up your time from second-guessing your options, and simultaneously, I will be offering you guidance on how to make decisions faster, and start building the foundation for more impact and better and faster results.

For example, this is how I would recommend answering questions about your past failed company in a way that shows leadership and personal accountability:

- I saw that the risk was increasing, so even though I did not know it could be so bad, I was able to reduce the total budget we allocated to crypto lending projects by 10%.

- I saw that the situation was unsustainable long-term, and even though I was not able to influence my company to change their strategy, I did it for my personal finances (…) and I was also able to renegotiate our partner contract and lower the monthly fees.

- I had to let go of half of my team as a result of the restructuring, but I made several introductions to help them find new jobs and wrote multiple referrals for each of them on LinkedIn.

- I started reading about staking and self-custody technical solutions, to better understand how it works because I believe this is where our industry will move next.

Compliance Collective is a monthly group coaching experience built on two main pillars:

- Monthly Workshops teaching you how to drive forward and successfully complete the most common compliance-related projects within FinTech (see the schedule below);

- Group Coaching Monthly Office Hours where you can ask me and other participants any questions about your “situation” or a problem that makes you feel stuck, overwhelmed, or frustrated. This is also an opportunity to learn from others in the same “boat”. This is where we will apply the “just in time” principles to the specific headaches and problems you face.

Bonus 1: you will get instant access to the Compliance Accelerator recorded training focused on networking skills, building authority, and establishing your credibility in FinTech:

- Changing jobs in FinTech Compliance. Strategies for resumé building, interview conversations, assessing whether this company is a right fit for you, and completion of home assignments.

- How to find and secure board seats and paid advisory roles with FinTech startups.

- How to select your specialization or expert niche within FinTech compliance so that you get known for your signature know-how and start sharing your unique perspective and insights.

- How to start building relationships with media, industry experts, and influencers

- How to engage with your growing audience, create a following, and build your future clients’ pipeline.

Bonus 2: free access to any new workshops and training I offer during the time you remain a member of the Compliance Collective (I have a history of creating 3-4 new workshops a year, based on the hot topic emerging in the industry).

12 Monthly Workshops (one each month during the next 12 months):

- Annual Compliance Reporting (March 2023)

- FinTech Licensing for Self-Starters (April 2023)

- How to Open Bank Accounts (to be announced)

- FinTech Business Wide Risk Assessment (to be announced)

- White-Label vs Licensing (to be announced)

- E2E Scope of Crypto Compliance (to be announced)

- Faster Onboarding of Corporate Clients (to be announced)

- Creating your Privacy Policy and GDPR Compliance (to be announced)

- Managing Outsourcing documentation (to be announced)

- Structuring White-label Solutions in FinTech (to be announced)

- Managing Compliance Resources and Compliance Budget (to be announced)

- Preparing your FinTech for audits (to be announced)

Click HERE to learn more about the Compliance Collective and please let me know if you have questions!

Tune in to this episode on the Compliance That Makes Sense podcast! – Click here!