Advice to First-time MLROs or Heads of Compliance: Don’t Expect the CEO to Be Your Boss

One of the biggest mistakes that many first-time MLROs or Heads of Compliance make is that they expect their FinTech CEO or founder to become their manager and to act as a boss, and these expectations very often turn out badly. First-time or moderately experienced MLROs or Heads of Compliance (usually in their 30s) are very excited about their elevated authority, about having more freedom and autonomy, they anticipate FINALLY being able to implement the processes and improvements that they had in mind and correct all the errors and inefficiencies that did not work in the past under their previous bosses.

The problem is that they still want to have a boss, a supportive manager who will empower them, encourage or reassure them, help them learn different aspects of the business, help them solve organizational problems, or provide resources. Bad news – it almost never happens, even with the best CEOs or founders. Yes, formally, a FinTech MLRO or the Head of Compliance will report to the CEO or one of the founders, however, what most compliance people quickly discover is that their formal boss will quickly become their biggest problem, their biggest bottleneck, and their hardest critic.

The hard truth is that the vast majority of the FinTech CEOs don’t want to be responsible for compliance and they don’t view themselves as ultimate managers of the compliance function.

To be frank, the reason why they think they hire their Head of Compliance is to solve all the compliance problems so that they themselves don’t have to engage or think about compliance at all. When a well-meaning but very naive new MLRO tries to “involve” their CEO boss in a compliance decision or attempts to solicit their CEO’s opinion about risks and uncertainties around a particular issue, the CEOs become annoyed or irritated, and even when they try to understand the issue or offer their perspective, their underlying assessment of the situation is that this problem should have been solved without them and a long time ago.

I know, I know…

Many compliance leaders will try to argue that compliance cannot operate in isolation and that success in compliance cannot be produced in a vacuum, without support and buy-in from the senior leadership.

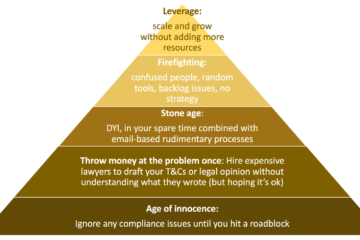

However, there is a difference between wanting someone to be your boss who takes ultimate responsibility for what happens and partnering with someone or securing their buy-in. My observation is that most FinTech CEOs would prefer that their Heads of Compliance act independently and on equal footing when it comes to recommending decisions.

What it means, is that they would like their compliance leaders to come up with solutions rather than listening to long explanations that end with “Now I have presented all information for you, and the decision is yours.” CEOs view this as lack of maturity, lack of accountability, poor preparation… they think that they are being forced to do the job that should be done by their head of compliance.

What’s the solution?

Well, if you are the Head of Compliance and you had to approach the CTO or the Head of Sales or another equal partner within the organization (not your boss) and secure their buy-in for your strategy, your approach would be different, right?

You don’t expect these other leaders to make decisions for you and you don’t expect them to guide you or motivate you. You would want them to understand the merits of your proposal and to see how this is the best approach for the company overall and for their respective function specifically. It would be a conversation between equally influential and equally busy partners. This is exactly the strategy I recommend you deploy when talking to your CEO (even if this is your formal boss). Let me ask you this: if you knew before you agreed to become the MLRO or the Head of Compliance or the CCO, that you would not really have a boss, that you are on your own and you should be ultimately responsible for the compliance function performance and deliverables, and that you are not going to have a boss in a classical sense, because your CEO is NOT going to motivate you or encourage you or reassure you… you will literally be on your own 99% of the time when it comes to decisions… do you still want the job and the challenge? If not – it is better to find the organization where there is a more senior compliance leader you can report to.

Seriously, compliance is a very cool and rewarding job, but it is also a lonely job when it comes to making decisions and standing by them. Find a mentor to support you.

Remember, if you lead a FinTech compliance function, the CEO is your partner, but NOT your boss.

Don’t miss this fresh episode on the Compliance That Make Sense podcast today! Listen now! 🎧

🚀 P.S. Did you know that my “FinTech Startup Compliance Pro” Certification program provides you access to over 40+ compliance policies and documentation templates, 15 compliance project management training for all essential compliance projects any FinTech startup may need (including implementation plans for each of them), and 5 dedicated workshops and coaching sessions helping you navigate through the most critical decisions and uncertain times). Check it out! ✨