5 Warning Signs in Negotiations

I have recently learned that it's important to say “no” to a project or an opportunity very early on, even if it’s commercially interesting or has a great potential - if it requires you to spend disproportionate amount of time or energy on fine-tuning minor details or endlessly clarifying slightly diverging views.

(To be clear – here I’m talking about equal partnerships where both sides have approximately the same power and influence and size. Obviously, if you are a small startup pursuing huge partnership opportunity with a major bank, these recommendations won’t apply, simply because you want them more than they want you, and their decision-making process is something you cannot change).

Here are my 5 red flags to watch for:

- More than 3 calls required to get to know each other and reach “yes” or “no” in principle.

- Long breaks of silence during negotiations (longer than a week, when you know the time is critical for the other side).

- A lot of time (more than 2 emails) spent on minor clarifications around NDA, conflicts of interest, termination provisions, and other non-commercial aspects.

- Unreasonable demands or one-sided penalties.

- Last minute requests to (adversely for you) revise previously agreed-upon terms.

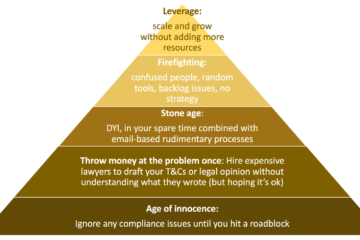

P.S. If you work in FinTech compliance and you are feeling like you are constantly reinventing the wheel, you may consider joining Compliance That Makes Sense program in September 2019 - join the waitlist and be the first to know when we open the doors again!