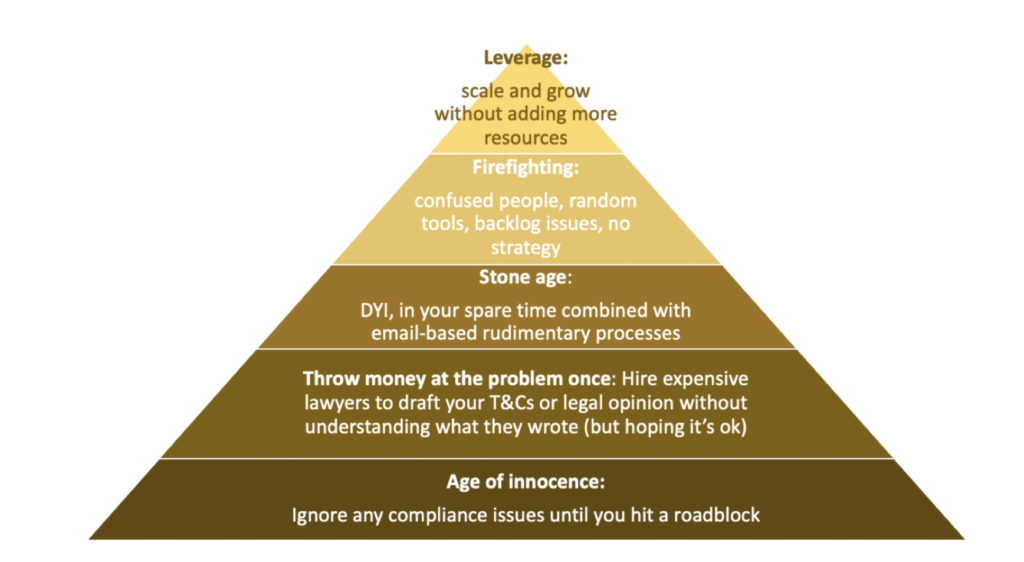

How Compliance Function Evolves Over Time

Today, I’m offering you a history lesson on how FinTech compliance goes from Stone Age to Leverage.

1. Age of Innocence: At the beginning of your FinTech compliance journey, you assume you are not regulated, too small, unprofitable, and therefore, no rules apply to you. You may be taking some funds from friends and family or experimenting with DeFi or AlgoTrading, and you will worry about compliance later.

2. Stone age:

- Your customer files are stored as Google Docs, your decisions about customers are done via emails or on Slack.

- Your transaction monitoring routine is supported by CSV file exports into excel.

- Expensive external lawyers have written some of your T&Cs or policy documents, but nobody in the company actually read it or knows if it’s still relevant. You just hope it’s ok what they wrote and you proudly mention that this policy or document was created by the Big 4 company.

- Your customer onboarding may be semi-automated but after the customer uploads the documents and you get the data, all the following manipulations and decisions are manual. You don’t have good internal admin tools or dashboards, you don’t have any customer tags, and when you do sanctions scanning or blockchain tracing, it’s manual and the results are saved as screenshots.

- Your next audit or regulatory inspection will turn out badly, this is when you will hire more people and deploy more random tools and will graduate into firefighting mode.

3. Firefighting:

- You have hired a lot more people into risk and compliance, you deploy many tools (that don’t agree on some of the alerts and results they generate), and you constantly talk about your backlog of the issues.

- Your compliance cost per customer is getting more expensive day by day.

- You have wasted lots of resources preparing for projects that never went live and you waste a lot of resources on customers that register but don’t transact.

- Your customers are complaining a lot about how long they need to wait while you review them.

- Your company suffers from internal conflicts between compliance, product, engineering, and customer support, and you have a feeling that everything is slow, despite all the resources you put into compliance.

4. Leverage: For some products or some services or some partnership channels you managed to find the right balance between compliance and growth, which means that each next customer costs you less to onboard and maintain than the previous customer. You have a few compliance tools and vendors and you consolidate information about them within a single dashboard.

- You don’t need to hire temporary interns to address and resolve your backlog, your audits and regulatory inspections are clean and you actually get positive feedback.

- Your compliance team is spending the majority of their time reviewing new projects and new opportunities and future ideas instead of focusing on formalities, audits, and reporting.

- You found the right balance between what you need to develop in-house in terms of technology and documents versus what you outsource to vendors and external lawyers and consultants.

- Your financials look healthy and you can raise more funds because of that.

If this resonates with you and you’d like to learn more about the Just in Time vs Just in Case Compliance approach in FinTech, you can listen to this audio series here.